🏦 How Lenders Actually Underwrite Loans (Not What Borrowers Think) 🔍

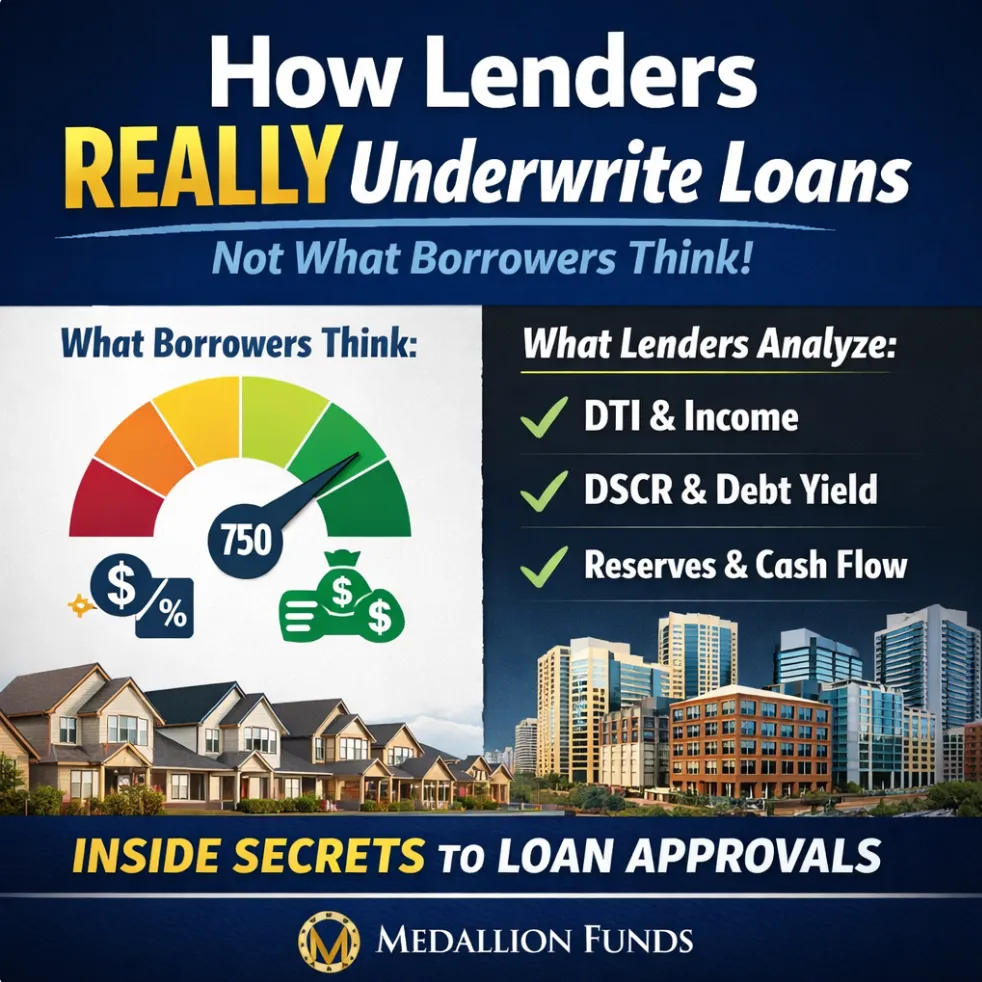

How Lenders Actually Underwrite Loans (Not What Borrowers Think) Most borrowers believe underwriting is about credit score and rate shopping. It’s not.

How Lenders Actually Underwrite Loans (Not What Borrowers Think) Most borrowers believe underwriting is about credit score and rate shopping. It’s not.

The Role of Mortgage Brokers in CRE Financing: Why Investors Rely on Experts for Better Deals Commercial real estate (CRE) financing has become increasingly complex. Whether you’re buying an industrial facility, refinancing a retail center, or structuring debt for a new development, navigating today’s CRE capital markets requires precision, lender relationships, and strategic insight. This is where a commercial mortgage broker becomes indispensable.

💰 The Truth About Bank Statement Loans: Who Qualifies & Who Doesn’t For business owners, freelancers, and 1099 earners, qualifying for a mortgage shouldn't feel like trying to fit into a box that was built for W-2 employees. That’s exactly why bank statement loans exist — and why they’ve become one of the most powerful financing tools in the 2026 lending market.

💸 How to Avoid PMI the Smart Way in 2026 Private Mortgage Insurance (PMI) is one of the most annoying home loan expenses buyers run into—especially first-time homebuyers. The good news? In 2026, buyers have more ways than ever to avoid PMI, reduce monthly payments, and increase buying power.